From the Pay Type window, press Add.

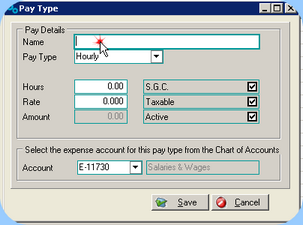

•Enter a Name for this pay type.

•Select the Pay Type of either Hourly or Salary.

•Enter the number of weekly hours normally worked under this Pay Type. (This can still be overridden in the individual employee set-ups if required.) Specify the normal hours worked for every Pay type – even Salary, as it is impossible to correctly calculate Holiday & Sick Accruals & Leave without a normal number of hours.

•If the Pay Type is Hourly, enter the usual per hour Rate for this Pay Type. This can be left blank if preferred, and set for each individual Employee, or put in an amount that can still be overridden in each employee screen.

•S.G.C. – Is the pay type you are creating included in the Ordinary Times Earnings (OTE) that are used to calculate the superannuation percentage? You need to know this for each of the types of pay you set up. This setting will apply for this Pay Type in every circumstance and cannot be overridden in either the employee screen, or in the Pay Wages screen.

•Taxable – Is the pay type you are creating included in the amount that tax is calculated on? This setting will apply for this Pay Type in every circumstance and cannot be overridden in either the employee screen, or in the Pay Wages screen.

•Account – Note that the account you have previously selected for Wages Expense will be showing here. This can be changed for each individual Pay Type if preferred. You should also note that the account selected in this Pay Type cannot be changed for each employee, and cannot be changed within a Pay Wages screen.