The stock card must correctly described when first creating the stock card by selecting the Consignment tick box

If the Consignment attributed isn't ticked at the beginning it can't be changed later. Rather it must be deleted by using the Return to Vendor function and in-stocked again.

A Consignment stock card is entered via the Detailed view, rather than the Summary view. No difference will be seen on the Stock, Detail or Options tabs.

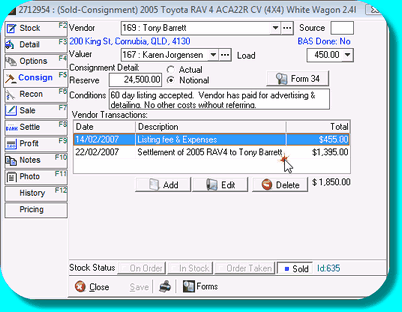

The Purchase tab becomes the Consign tab

•Client selection - note that if an ABN is entered in the vendor card, the Input Tax Credit Type will default to Actual in the same way as a non-consignment stock card. This has no relevance to the purchase of the stock item as it is not purchased, however it will affect the Tax Invoice produced for the end customer when the vehicle is sold.

•Select a Valuer if required – this is optional. Reporting is available based on this field.

•It is possible to add a Load to a Consignment vehicle – note that Load does not go to the General Ledger as it is only an estimate of overhead, not an actual cost. If you wish to see Load on Consignment stock cards, you may consider adding a separate Load Group called “Consignment”.

•The Reserve price is that agreed with the vendor. It can be entered to reflect the net price to vendor or the gross price – it is your choice as long as the figure entered is meaningful. It creates no accounting entry, but will appear on stock lists as a “purchase price”.

•Use the Conditions field to enter any notes or other terms relating to this transaction, such as the period of time you can offer the vehicle for sale, and whether the vendor has agreed to reimburse any costs.

•The Vendor Transactions window itemises each transaction created, with its description and amount, the total of all vendor transactions displayed at the foot.