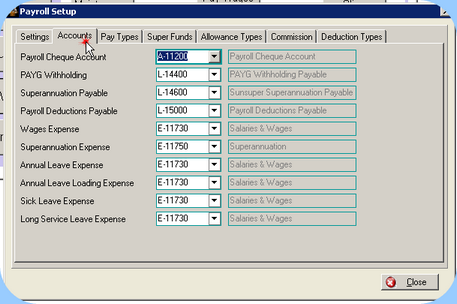

•Payroll Cheque Account should be linked to the GL account that is used to pay Wages. If Wages are paid electronically, you might consider creating a "clearing" bank account from which Wages are paid, and is then cleared back to the main bank account.

•PAYG Withholding is the liability account to hold the Tax that you have deducted from your employees wages, and is pending payment to the Tax Office. When you periodically remit this tax to the ATO via a Business Activity Statement, the account will be cleared.

•Superannuation Payable is the liability account to hold the Superannuation that you have allocated within wages entries and is pending payment to the appropriate Superannuation Funds. When you periodically remit these amounts to the super funds, the account will be cleared.

•Payroll Deductions Payable is the liability account to hold the amounts that you have deducted from your employees wages pending payment to a third party, such as Child Support payments. When you periodically remit these amounts to the third parties, the account will be cleared.

•Wages Expense is the account that is selected by default as the expense account for the category ‘Pay’. Items such as retainers, salaries, hourly wages etc will use this account by default however this can be overridden in each individual Pay Type setup.

•Superannuation Expense is the account used to allocate the expense of the SGC (Superannuation Guarantee Charge). This amount is over and above the normal wages expense.

•Annual Leave Expense Annual Leave is normally paid in lieu of wages, so you can select the same account here as is selected for ‘Wages Expense’. This setting is available in case you need the flexibility of splitting up wages vs holidays. Regardless of which account you select to use, you must select something into this setting.

•Annual Leave Loading Expense Leave Loading is applicable to some employees depending on their award. It is a percentage calculation paid on top of holiday pay. Annual Leave is normally paid in lieu of wages, so you can select the same account here as is selected for ‘Wages Expense’. This setting is available in case you need the flexibility of splitting up wages vs holidays. Regardless of which account you select to use, you must select something for this setting.

•Sick Leave Expense Sick Leave is normally paid in lieu of normal wages, so can select the same account here as is selected for ‘Wages Expense’. This setting is available in case you need the flexibility of splitting up wages vs sick pay. Regardless of which account you select to use, you must select something for this setting.

•Long Service Leave Expense LSL can be allocated to a separate expense account, although you can choose to select the same Wages Expense account for this setting. The choice is yours.