To add Taxable & Non Taxable Components to change the GST or Tax on a purchase see the below example

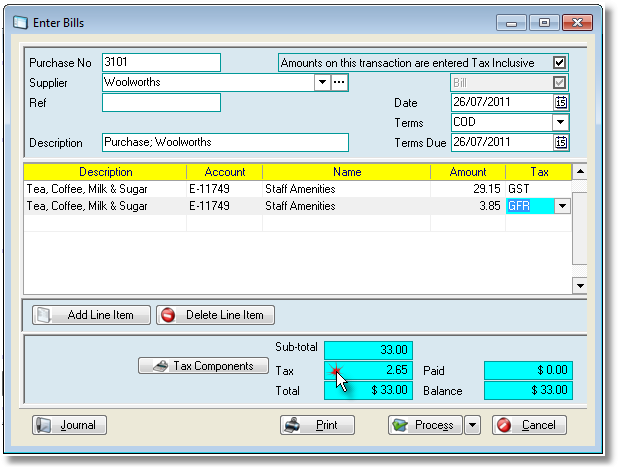

In this example we have purchased tea, coffee, milk etc from Woolworths. The total we have spent is $33.00 but as some of the items like milk are GST Free the total GST on the invoice is $2.65.

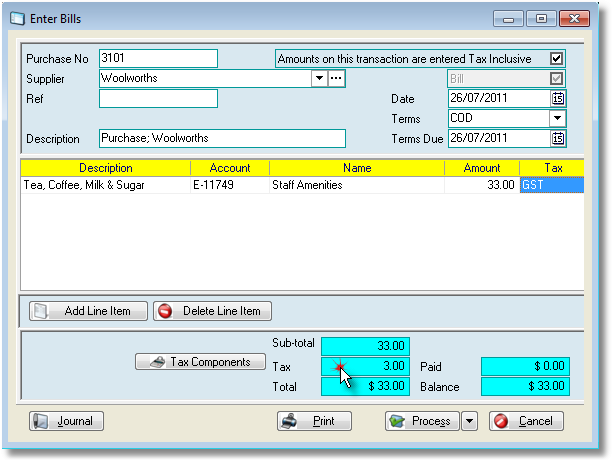

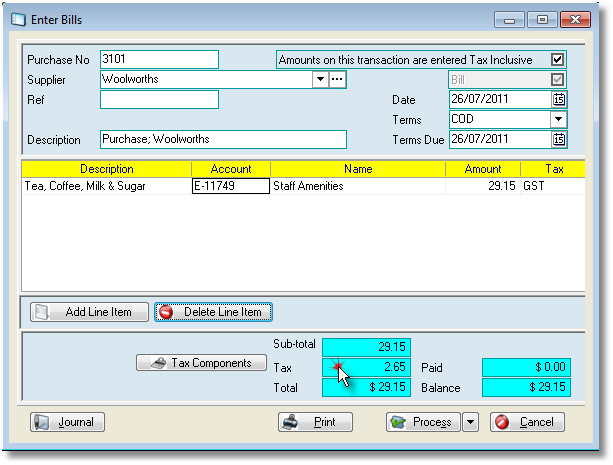

The first thing we need to do is change the 'Amount' in this line to the total amount of all the items with GST included (you can manually add them up or you can do what I do by multiplying the tax amount 2.65 by 11), see below.

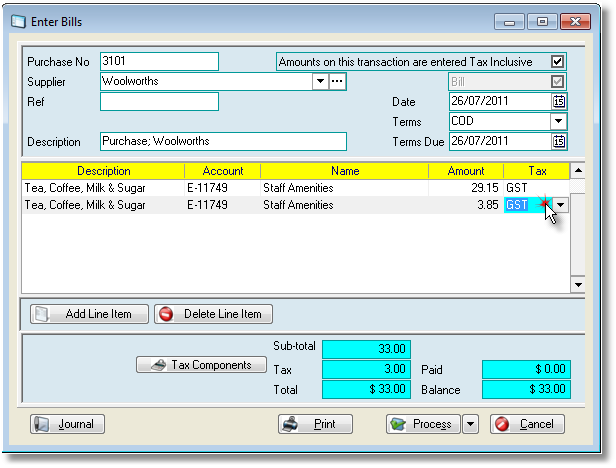

So now that the Tax amount is correct, we can add a second line to enter the GST Free part of the invoice,

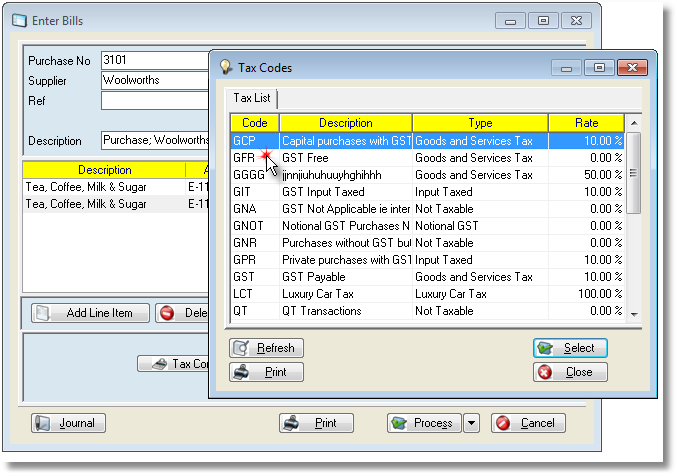

... but don't forget to change the Tax code to GFR.

Now this transaction equals the invoice and we now 'Process'.