Before converting to Dealerlogic Accounting you must first close off the last valid BAS period in Dealerlogic. (If you are a Quarterly remitter, and are converting at the end of January, you’ll need to close of the Oct – Dec BAS period.

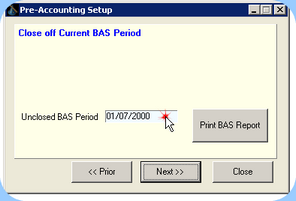

Unclosed BAS Period

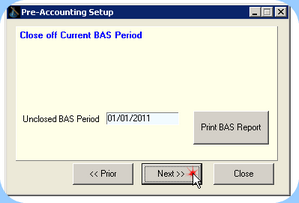

The Next Bas Period that appears in the Close off Current BAS Period window of the Setup Wizard (pictured above) is the last unclosed BAS period in your Dealerlogic software. If you have never closed off a BAS period or do not use the present Dealerlogic BAS report you will need adjust the next BAS date accordingly.

![]() Adjusting the next BAS due date manually

Adjusting the next BAS due date manually

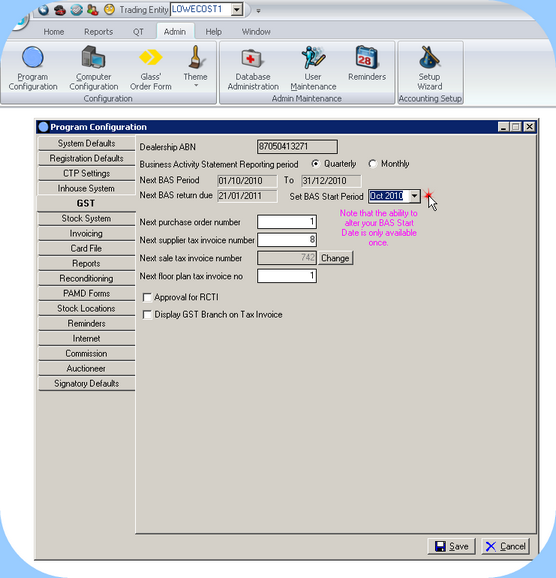

From the Admin ribbon select Program Config and go to the GST tab. Locate the field Next BAS return due and double-click on the date shown adjacent. Another field will appear: Set BAS Start Period. Open the drop box and select the first month of your next BAS reporting period.

Program Configuration, Set BAS Start Period

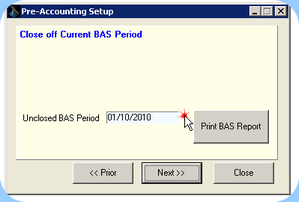

Unclosed BAS Period after date adjustment

|

If you are using the present Dealerlogic BAS report you will need to print and close off the BAS period that falls immediately prior to the conversion date. Similarly, the Next BAS Period displayed should be the period in which the conversion date falls.

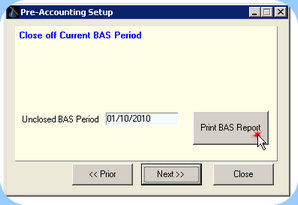

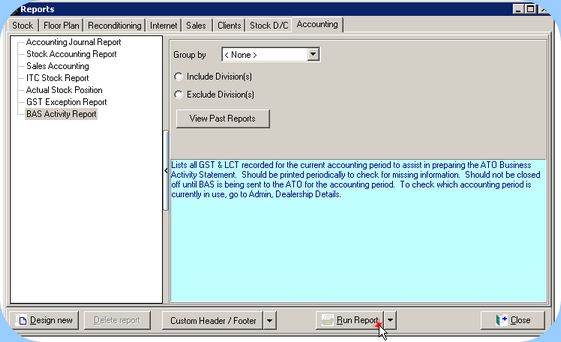

Print unclosed BAS Report for prior period

run the report to print it

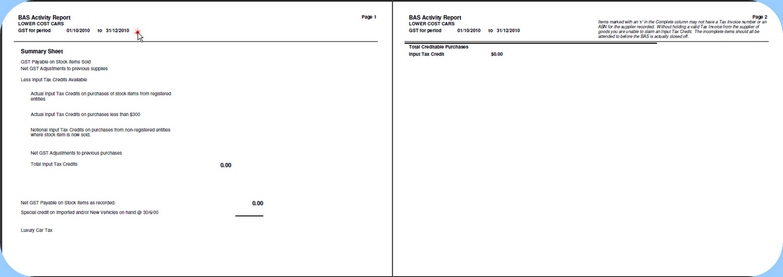

Opening BAS Printout

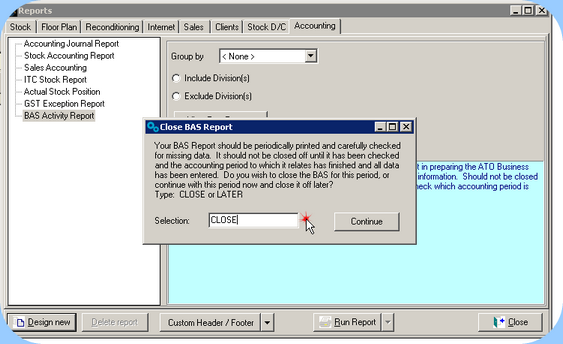

After the report has been printed, type in CLOSE and then select continue

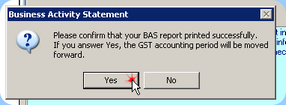

Answer YES to BAS close confirmation

Back in the Setup Wizard unclosed BAS period is correct. Click on NEXT to continue

NB: Any adjustment to the amounts on your last BAS period (the one you are about to print) must, if required, be made manually. Once you convert to accounting all previous transactions will become either historical or opening entries and will not appear on your Dealerlogic Accounting BAS report. Likewise, any adjustment to these entries will not appear on the Dealerlogic Accounting BAS report.

The carried forward GST liabilities for the current BAS period should be entered as part of your Opening Balances.