Deductions represent amounts withheld from an employee's wage to be paid elsewhere. Deductions might include such things as Union Fees, Christmas Club membership or Child Support payments.

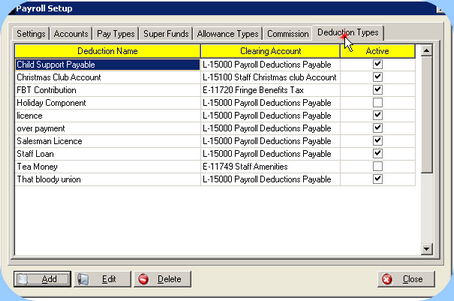

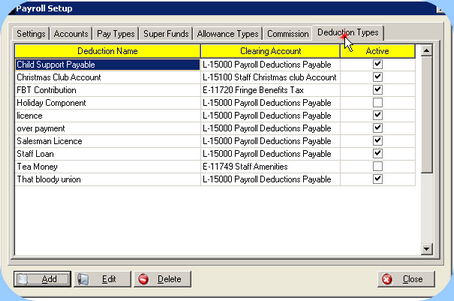

Prior to specifying a Deduction within an Employee Maintenance screen, the Deduction Type must be added to the ‘master list’ under Deduction Types on the Payroll Setup screen. Only Deduction Types listed here can be used within a Pay Wages entry.

Add a Deduction Type

•Click Add. The Deduction Type screen will appear

•Enter the Name of this Deduction and the usual Amount for this Deduction. The amount can be left blank if preferred, and set for each individual Employee, or you could put in an amount that can still be overridden in each employee screen.

•Union – Does this Deduction represent Union Fees? As Union Fees are identified on Payment Summaries (Group Certificates) it is important they are identified within the Wages system.

•Tax Deductible – If a Deduction represents an item that is Tax Deductible in the hands of the employee, this will result on tax being calculated on a lesser amount. This setting will apply for this Deduction in every circumstance and cannot be overridden in either the employee screen, or in the Pay Wages screen.

•Account – Select the expense account to which this Deduction should be credited. This is often a Liability account, where the amount is owed to the third party. Note that the account selected in this Deduction will apply in every circumstance. It cannot be changed for each employee, and cannot be changed within a Pay Wages screen.

•Click Save.

Change the settings of an existing Deduction

•Click Edit. The changes will only apply to new Wage entries created (not affecting historical entries)

Delete a Deduction

•Click Delete. Only Deductions that have not been recorded within an actual Wage Journal can be deleted.