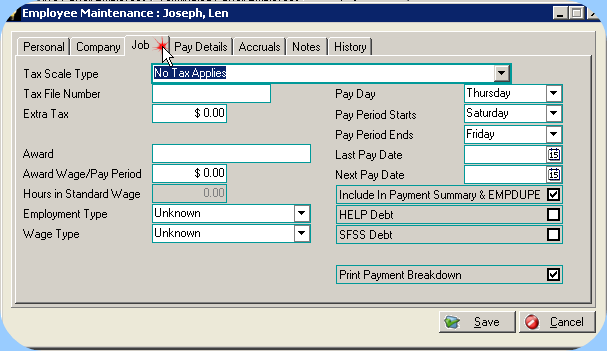

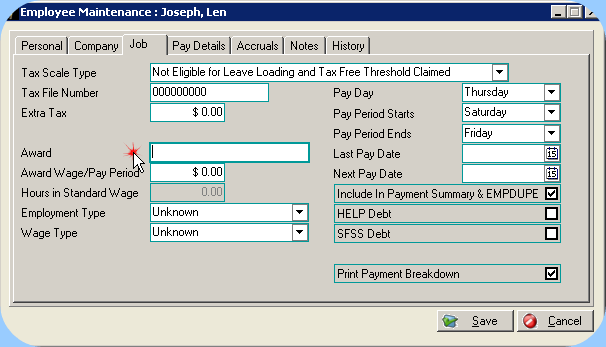

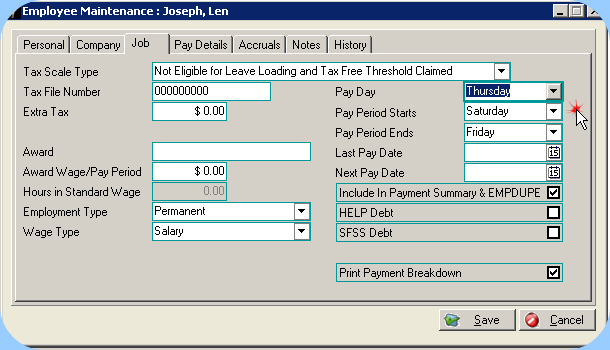

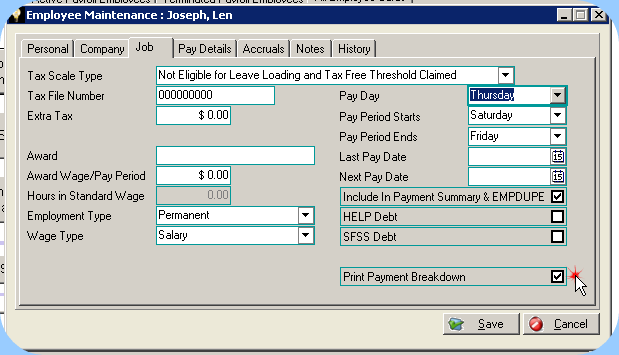

Job Tab

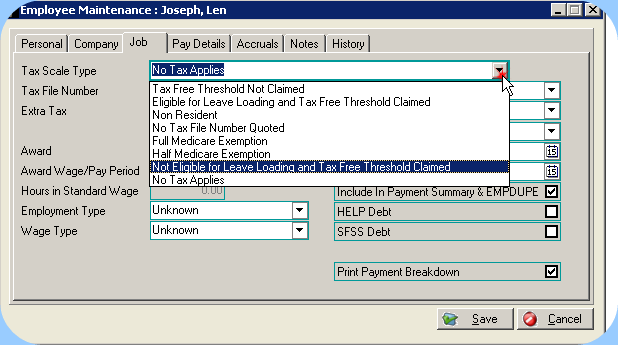

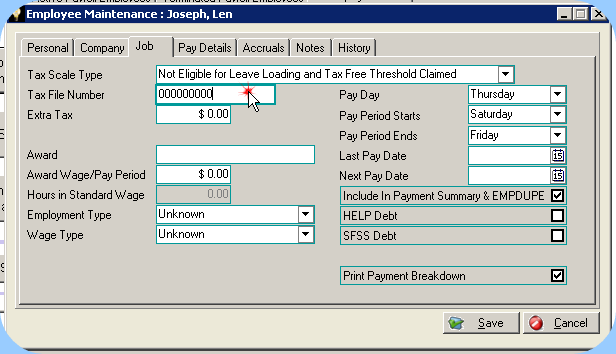

•Select the correct Tax Scale for this Employee. Refer to the Employees Tax File Declaration for clarification if necessary. If unsure refer to the list of wages information resources or ask your accountant for advice.

Tax Scale Type

•Tax File Number must be entered. Dealerlogic checks the number that you enter for validity using the ATO’s TFN formula. If the employee has not yet provided a TFN, enter 9 zeroes into this field.

Tax File Number

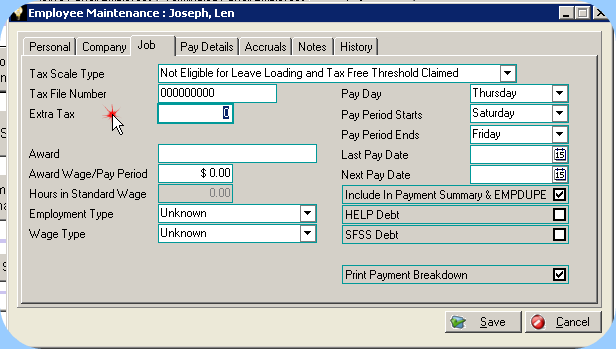

•Enter any dollar amount of Extra Tax your employee requests you withhold from his wages, in addition to tax calculated according to the selected Tax Scale Type. Note: this field can be used to record a “minus” amount in order to reduce standard tax if the employee has any type of tax variation in place.

Extra Tax

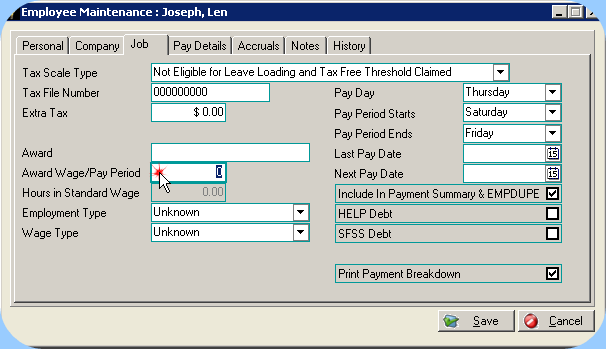

•Award can be entered for your own reference purposes. This is an optional field and by entering an award you will not change any other behaviour. It may however be useful information for your future staff management to be able to refer to the correct Award title.

Award

•Award Wage/Pay Period – this field is again available for your own future reference, and does not affect the wages behaviour in any way. If desired, enter the weekly wage applicable to this employee under their appropriate award.

Award Wage

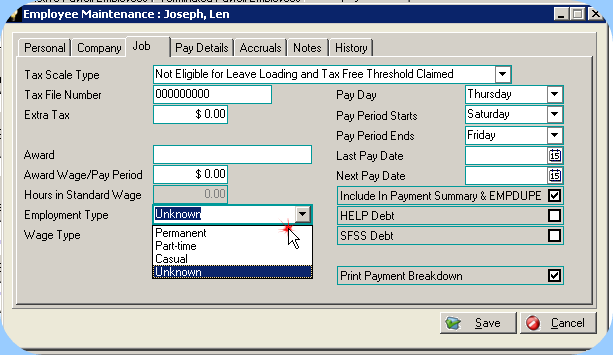

•Select the correct Employment type: Permanent, Part-Time (attracts holiday & sick pay) or Casual (does not attract holiday or sick pay). Note: Selecting any of these types will not control behaviour, it is simply used as reference. To exclude an employee from holiday or sick pay, these items must be de-selected in their Employee Maintenance screen.

Employment Type

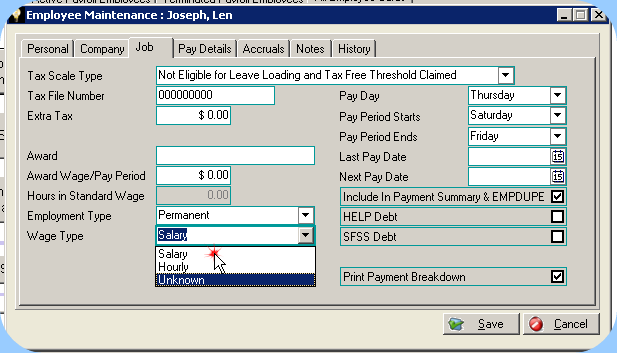

•Select the correct Wage Type. Salary indicates the employee is paid a set amount per week regardless of hours worked, however even salaried employees still require the amount of hours normally worked in a week in order to determine the correct rate for holiday & sick pay. An hourly worker would generally be compensated for overtime but of course this is controlled by you as you set up each employee.

Wage Type

•Pay Day – select the normal payday for this employee. You will see that when you open a Pay Wages screen the date will be determined by the selection you make here. If you select Friday, the Pay Wages screen will select the next available Friday based on the Next Pay Date indicated.

•Pay Period Starts indicates the day of the week that is the start of the pay week.

•Pay Period Ends indicates the day of the week that is the end of the pay week.

•Last Pay Date indicates the last date a Wages entry was recorded for this employee. Note however that if a wages entry is created and later deleted, the pay date will not be updated in this screen.

•Next Pay Date indicates the next due pay for this employee based on the last date a wage was recorded. If you have deleted a pay entry, adjusting this date manually will ensure the next pay is correctly dated.

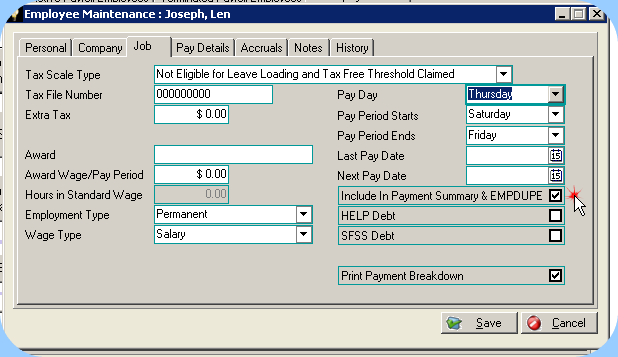

•Include in Payment Summary & EMPDUPE indicates whether you will require a Payment Summary (Group Certificate) printed for this Employee – Empdupe is the electronic summary file of all Payment Summaries issued.

Include In Payment Summaries

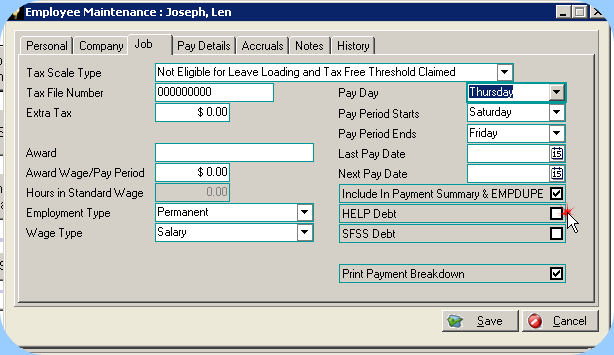

•HELP represents Higher Education Loan Program. Select this field if the employee has indicated via their Tax Declaration form that they have a HELP debt. This will affect the amount of tax deducted from their weekly pay.

Higher Education Loan Program

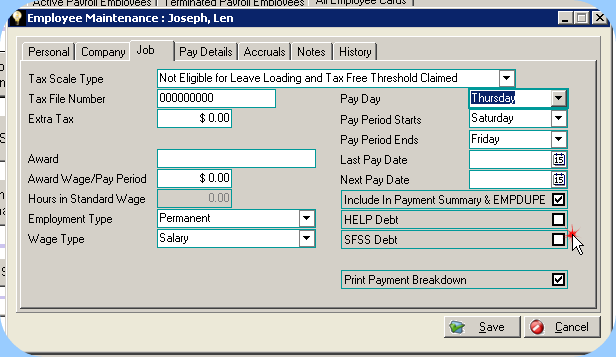

•SFSS represents Student Financial Supplement Scheme. Select this field if the employee has indicated via their Tax Declaration form that they have a SFSS debt. This will affect the amount of tax deducted from their weekly pay.

Student Financial Supplement Scheme

•Select the Print Payment Breakdown field if the employee requires the bank account or payment details weekly.

Print Payment Breakdown