Once the customer has paid the balance owing, you will need to account to the vendor for the sale proceeds now held in trust, less any commission and/or costs. The full sale price of the vehicle plus any Extras sold is held in the Trust account; some will be paid to the vendor, and some to the dealer’s trading account in settlement of commission, Extras etc.

A Vendor Consignment Transaction, type Net Selling Price is now prepared to reflect the full settlement to the Vendor. This transaction is not available to select until the stock card is marked as Sold. It is the transaction used to account to the vendor for the sale price less commission, and it will create a Purchase transaction. A stock card may have only one Net Selling Price transaction.

•From the stock card open the Consign tab;

•In the Vendor Consignment Transaction area, press the “Add” button;

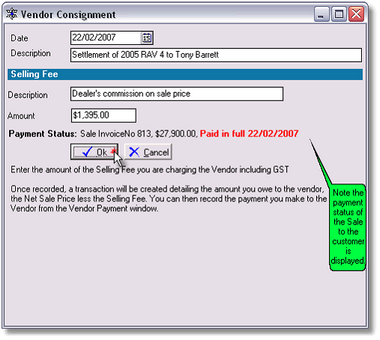

•Enter the date and description for the transaction;

•To add a line item, press the “Add” button and select Net Selling Price;

•Enter the description of the commission/selling fee charged to the vendor and the amount;

•Note the status of the Sale to the customer is displayed for your reference;

•You will be paying back to the vendor the amount displayed as the Sale Invoice amount less the Amount shown as Selling Fee;

•Press Ok when complete;

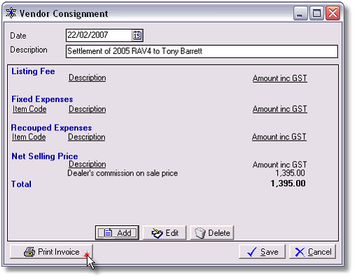

•Only one Net Selling Price transaction can be created, however once created, it can be later edited

•The Net Selling Price is then saved and can be printed as a Tax Invoice to the vendor. (A Tax Invoice is required to itemise the commission being changed to the vendor.)

•Use the “Print Invoice” button as shown at left