A General Journal is a transaction that enables you to make adjustment entries to your accounts without creating a sale or purchase transaction.

General Journals are often created by your accountant to make adjustments to your accounts. An example of a common General Journal is the adjustment made at the end of financial year for your depreciation of assets. A General Journal is used because you are not actually buying or selling anything but adjusting up or down the amounts that appear in particular accounts.

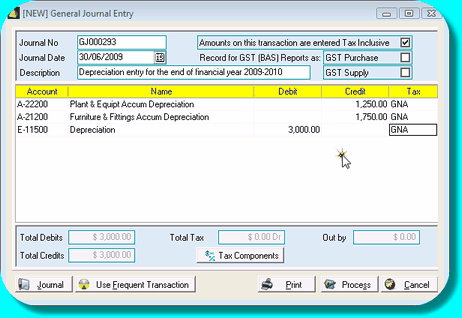

![]() Create a General Journal Entry

Create a General Journal Entry

•Open the General Journal Entry Window by clicking General Journal Entry in the Logic Centre or Dealerlogic Menu. •Dealerlogic will automatically allocate the next available Journal number. Journal numbers for General Journals are prefixed with GJ for easy identification.

•Select the date for the General Journal. In order to show the adjustment you are making in the correct accounting period, the date of a General Journal can be forward or post dated. •Enter a meaningful description for the General Journal (E.g.: Depreciation end of financial year 2008-2009) •Select the correct GST and BAS reporting behaviour for the type of entry you are making. Your accountant is best to advise you in this regard. Indicating that the entry is either a GST Purchase or a GST Supply will result in the entry being recorded on the BAS, and it also indicates whether the GST in the entry (if any) will be recorded as GST Payable or GST Input Credit. If the Tax Code selected is anything other than GNA (GST Not Applicable) you will be required to select either GST Purchase or GST Supply. •Click in the Account field to display the Combo. •Click the combo to display the list of available accounts from the Account Selection Window. Tip: To make locating the correct account easier, clicking the check boxes at the top of the Account Selection Window enables you to filter the list of available accounts. •Select the desired account to Debit from the Account Selection Window by double clicking it with your mouse or highlight the account and click the Select button. •Enter the Adjustment Debit amount in the Amount field. •Click in the Account field on the next line and repeat the process above for the Credit side of the Journal entry. NB: Both sides of the entry (Debit & Credit) must balance before you can process the General Journal. •Click in the Account field on the next line and repeat the process above for the Credit side of the Journal entry. •If the General Journal is now correct, click Process. The Tax Codes used for your selected accounts in the General Journal are sourced from the Account Details in the Chart of Accounts. Dealerlogic automatically inserts the corresponding codes into the General Journal however if required, you can click in the Tax field and select a different Tax Code from the Tax Code list. Alternatively, you may have a requirement to manually alter the tax for all or part of either side of the General Journal entry. |

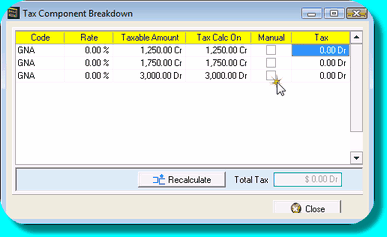

![]() Adjust the General Journal Tax Components

Adjust the General Journal Tax Components

•Click the Tax Components button on the bottom of the General Journal Entry Window. The Tax Component Breakdown will be displayed.

•Enter a manual tax amount(s) in the Tax field. •Click the close button. Note: To restore the tax calculation from the selected accounts Tax Code click the Recalculate button. |