Import Vehicles

Importers don’t record the ITC on the stock card but take all the GST up in the customs invoice that is processed via the Reconditioning. The reason for this is that the GST is charged on the purchase price as calculated on the conversion rate when the vehicle arrives in the country.

To process the GST

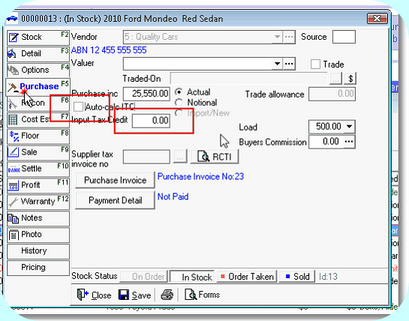

•Enter vehicle into stock for the actual purchase price.

•GST status should be ‘Actual’

•Untick the auto-calc ITC button on the purchase tab and bring the Input Tax Credit back to zero – save stock card

GST Actual, Untick Auto-Calc and Imput Tax Zero

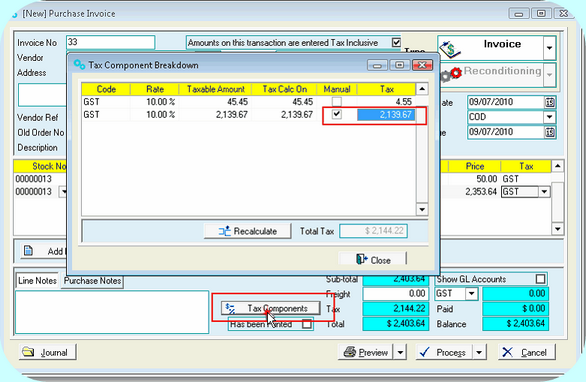

When the invoice arrives from customs, enter it in as reconditioning and auto calculate the GST, by selecting the ‘tax components’ button and ticking manual GST calculations

Select 'tax component' button, tick Manual GST calculations