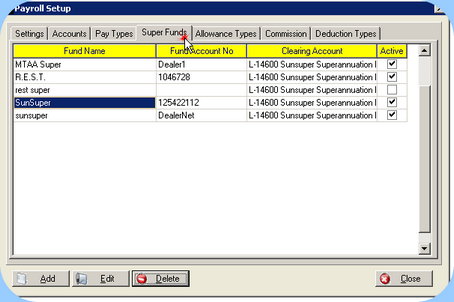

Prior to allocating a Super fund to an individual employee, the Super Fund must be added to the ‘master list’ under Super Funds on the Payroll Setup screen. Only Super Funds listed here can be used within a Pay Wages entry.

Add a Super Fund

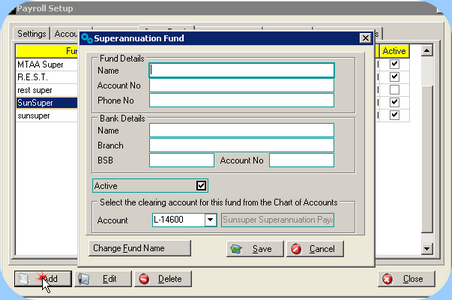

•Click Add. The Super Fund setup screen will appear.

•

•Enter the name of the Super Fund.

•Enter the Employer reference number if applicable. Note, this number is specific to the Employer, not the employee and is used when lodging Superannuation Remittances.

•If the Super Fund is paid by direct bank credit, enter the banking details.

•The fund is set as “Active” by default, but may be made “Inactive” by de-selecting the tick box. An Inactive fund will not appear within other selection lists. Do this if a super fund was only linked to one employee, and that employee has since left.

•Select the account number to be debited for this Super fund. This is generally a Liability account, as the money is owed to the Super Fund. Note also that the account that appears is the one previously specified in the Account Settings, however it can be overridden for each individual Super fund if required.

Change the settings of a Super Fund

•Click Edit. The changes will only apply to new Wage entries created (not affecting historical ones).

•A Fund Name may be changed using the special function “Change fund Name” button.

Delete a Super Fund from the list

•Click Delete. Only Super Funds that have not been recorded within an actual Wage Journal can be deleted.