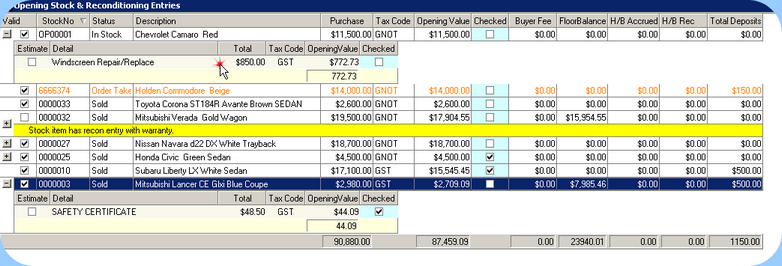

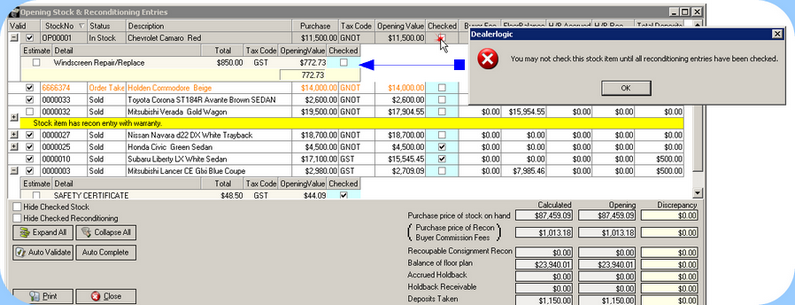

The Opening Stock and Reconditioning Entries window displays all of your current in stock vehicles and their relevant details to assist you in arriving at your correct opening stock, reconditioning, holdback and floor plan balances.

The amounts that you enter into the Opening Account Balances window once complete will be inserted into your Opening Balances.

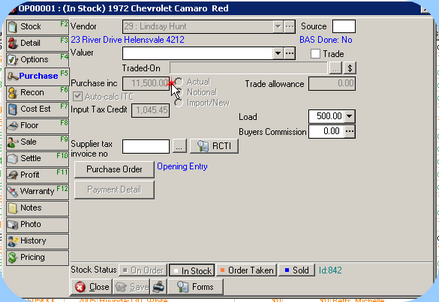

![]() Opening values for stock purchases

Opening values for stock purchases

The Purchase Price entered in the stock card (see Adding a Stock Card ) is used in conjunction with the ITC Type selected to determine the Opening Value. Tax Type GST indicates that an ITC has already been claimed for this stock item and the GST exclusive portion of the Purchase Price will be used as the Opening Value. Tax Type GNOT indicates a Notional stock item where the ITC has not yet been claimed, and the GST Inclusive Purchase Price will be used as the Opening Value. Note that a Notional stock item with Taxable Floor Plan will use the GST Exclusive portion of the Purchase Price, as the available ITC was claimed when Floor Plan was applied.

Opening Stock Stockcard, Purchase Tab

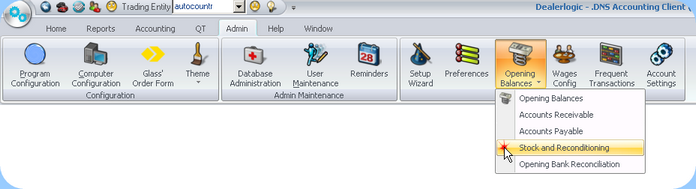

Locating Opening Balance Stock & Reconditioning List

Opening Stock Listing

|

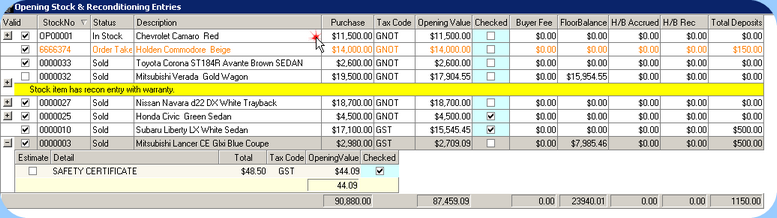

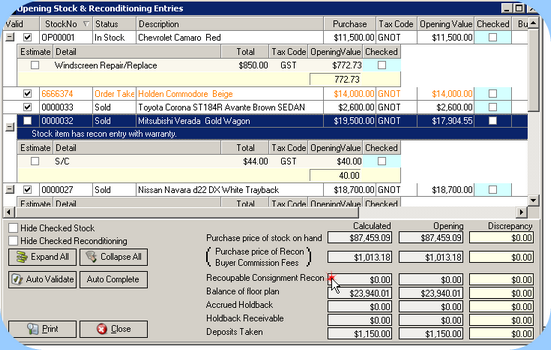

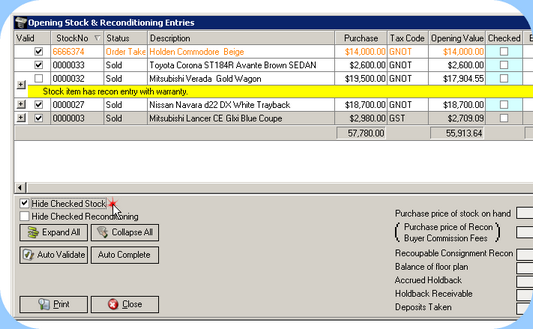

![]() Opening values for recon purchases

Opening values for recon purchases

The cost price is used in conjunction with the Tax Code entered into the reconditioning entry to determine the Opening Value. Included in Recon costs are any Buyer Fees attached to stock cards. Note: If you are new to Dealerlogic and are converting "with balances", rather than enter every single recon item separately, you can enter all the recon items as one consolidated line item per stock card.

Opening Stock Stockcard, Recon Tab

Opening Reconditioning Listing

|

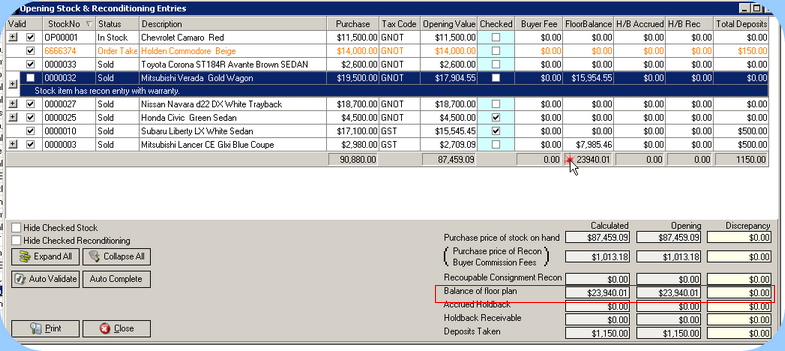

![]() Opening values for Recoupable Consignment Recon

Opening values for Recoupable Consignment Recon

Cost price of all recon items applied to Consignment stock marked as Recoupable are included here.

Total of Opening Value Recoupable Consignment Reconditioning

|

The Taxable Supply indicator on the stock card is used to determine whether the floor plan balance includes GST or not. The net floor plan owing is displayed less GST if applicable. When setting up your opening balances in Dealerlogic Accounting there is no provision to account for outstanding Floor Plan balances on sold stock items. You must ensure that all sold vehicles have had Floor Plan payouts recorded in both your stock system and your previous accounting system before entering the payouts due as opening payables.

Listing of Opening Stock Floor Plan

|

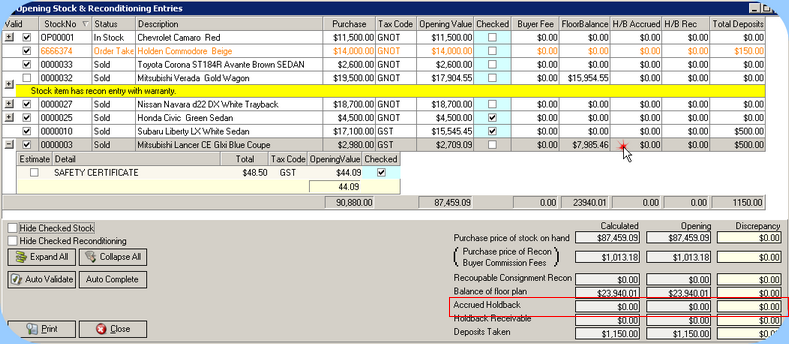

Holdback values as recorded from the stock card as used to calculate these values. Accrued Holdback is the total of Holdback recorded on current stock, and Holdback Receivable is the total of outstanding Holdback amounts on current stock. See also Holdback.

Holdback Totals

|

To provide a visual reference that stock items have been checked, use the Checked tick box adjacent to each item. Note that individual recon items must be Checked prior to marking the stock item as Checked. Items marked as Checked can be hidden from the grid to make further checking simpler. Additionally the entire list can be printed if you would prefer to check stock from a hard copy.

Checking Stock Items

Hide Checked Stock Tick Box

|

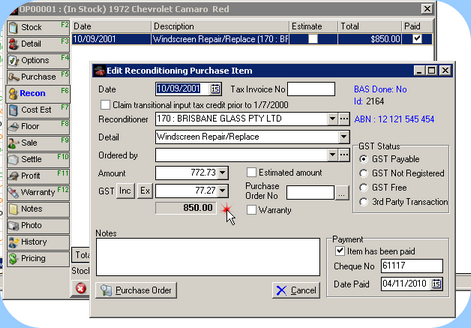

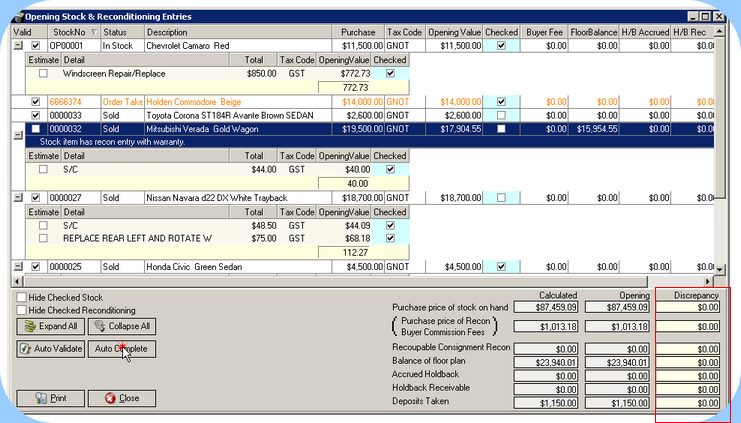

![]() I've checked my stock and can move to the next step

I've checked my stock and can move to the next step

Once you are satisfied that your opening stock items are completely correct, use the Auto-Complete button to use the Calculated figures from the Opening Stock & Recon Grid to populate the Opening Balances for all linked accounts (see Opening Account Balances ). Note that if later changes are made to any stock item or associated value, the Opening Balance must be adjusted. The reconciliation grid at the foot of the Opening Stock & Recon window should not show any discrepancy.

Opening Stock Auto-Complete |