Dealerlogic can produce Payment Summaries (Individual Non Business) in the correct format as prescribed by the ATO.

If you choose to self-print plain paper Payment Summaries, the Payment Summary Annual Report (Empdupe) file is also created for uploaded to the Tax Office via the ATO Business Portal or the ECI software for direct transmission

You may choose to use the pre-printed Payment Summaries issued by the ATO and in this case Dealerlogic can help you complete them by printing out the information you’ll need in a convenient report format.

Before starting, ensure each employee recorded in Dealerlogic is correctly set up.

•Only Employees for whom you’ve ticked “Include in Payment Summaries and Empdupe file” can be selected and included in Payment Summary printing or reporting. Additionally, note that All employees with this field ticked will be included in the Empdupe file regardless of whether you print a Payment Summary or not. Ensure that business owners, directors, contractors etc do not have this field ticked, as you may inadvertently send their wage data to the ATO even though no Payment Summary was printed.

Ensure each employee for whom a Payment Summary is required has their correct Tax File Number entered, and full and correct residential address. Note that the ATO states date of birth is optional – Dealerlogic will not print this on the Payment Summary even if it is recorded on the card file.

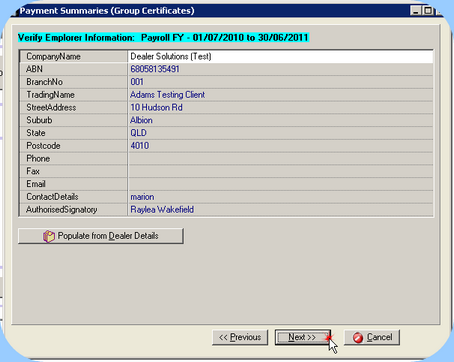

Once the employees’ setup is correct, open the Payment Summary wizard from the Logic Centre Wages menu, or the Accounting, Wages menu. The Wizard will step you through the procedure of printing the Payment Summaries (or printing a report to assist you to complete the ATO pre-printed Payment Summaries) and creating and saving the Empdupe file.

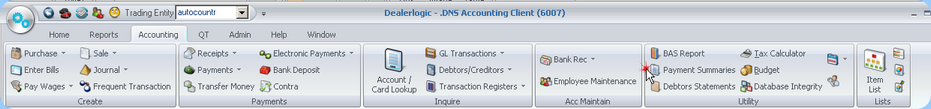

Payment Summary Wizard

Payment Summary Wizard

All Payroll Financial Years for which wage data is recorded are available for selection. That means you can reprint a Payment Summary from a previous financial year, or you can print a Payment Summary for an employee part way through a “future” financial year, say for termination. Select the required financial year, and press Next.  Payroll Financial Year |

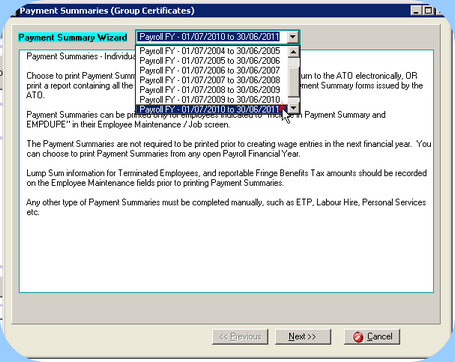

Ensure the name, address & contact details for the company are inserted and correct. Details recorded in the Dealer card file can be inserted by clicking the “Populate from Dealer Details” button, then adding any additional information required. Once complete, press Next.  Verify Employer Information |

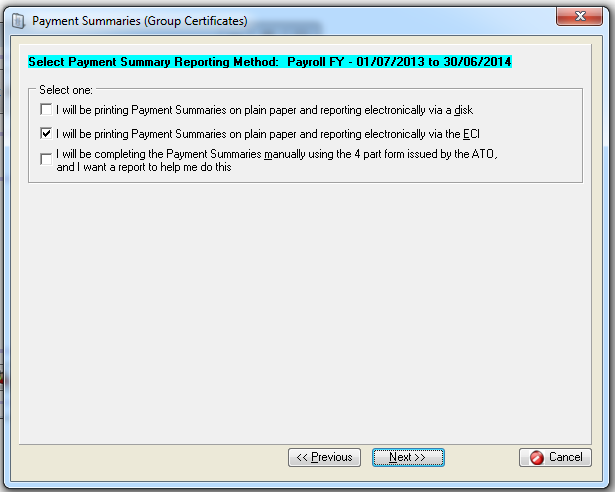

![]() Select Payment Summary Reporting Method

Select Payment Summary Reporting Method

Choose your preferred reporting method for this year. Anyone can print plain paper Payment summaries – you do not need to obtain prior permission from the ATO. The Payment Summaries produced by Dealerlogic are in the ATO approved format (formats can change from year to year). Note that all Payment Summaries produced for the financial year must be on the same format – i.e. if you produce a Payment Summary part way through the year for a terminated employee on the pre-printed ATO stationery, the Payment Summaries you produce for other staff at the end of the financial year must also be on the pre-printed ATO stationery, not plain paper. Select the correct method and click Next.

|

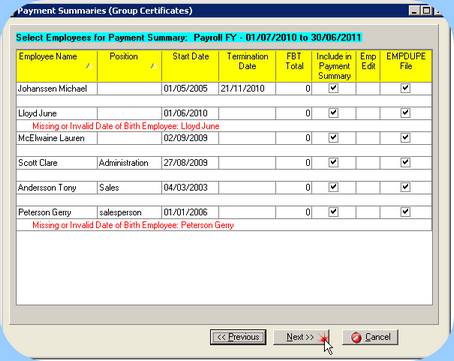

![]() Select Employees for Payment Summaries

Select Employees for Payment Summaries

This step will check for missing information such as address, tax file number etc. Additionally FBT can be entered here if required. To correct missing detail, or to add FBT data, click into the Employee Edit column as indicated left. The Employee Maintenance screen will open, and from there you can open the card file for editing, on saving and closing you will be returned to the Payment summary wizard. Note that the ATO states date of birth is optional – Dealerlogic will not print this on the Payment Summary even if it is recorded on the card file. Missing or Invalid Dates of Birth will not stop the printing of Payment Summaries.  Select Employees Note that details for all employees with wage data in the selected financial year must be correctly recorded, regardless of whether you wish to print that employee’s Payment summary at this time. If any employee has missing data, you will not be able to move to the next step (except for Missing or Invalid Date of Births). Note that once the missing data is complete, the edits disappear and you may move to the next step. |

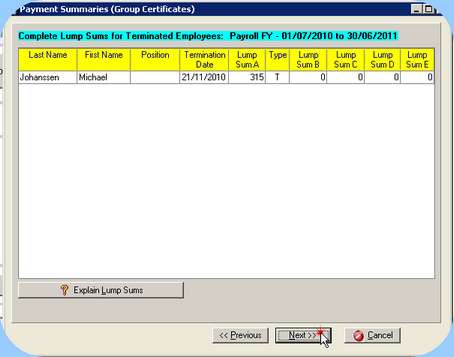

![]() Complete Lump Sums for Terminated Employees

Complete Lump Sums for Terminated Employees

This step requires the insertion if applicable of any lump sums paid on termination to employees whose employment terminated during the selected financial year. The lump sums will be printed on the Payment Summary at the appropriate location. Entering lump sums makes no difference to any tax calculation that has occurred. It is assumed that if any special tax calculation were required, it would have been done manually at the time of making the payment – see section on ETPs.  Lump Sums For assistance with clarifying the various lump sums, use the “Explain Lump Sums” button. For your information, that text is reproduced here . |

Lump Sum A - the amount you paid for: •unused long service leave that accrued after 15 August 1978, but before 18 August 1993 •unused holiday pay and other leave-related payments that accrued before 18 August 1993 •unused long service leave accrued after 17 August 1993 or unused holiday pay and other leave-related payments, where the amount was paid in connection with a payment that includes (or consists of) either •a genuine redundancy payment •an early retirement scheme payment •the invalidity segment of an ETP or super benefit. For other amounts of unused leave accrued after 17 August 1993, check the ATO website. If an amount has been included at Lump sum A, you must also complete the 'Type' box to show the circumstances the payment was made under. The only valid codes are: •R - if the payment was made for a genuine redundancy, invalidity or under an early retirement scheme •T - if the payment was made for any other reason.

Lump Sum B - Amounts you paid for unused long service leave that accrued before 16 August 1978.

Lump Sum D - The tax-free component of a genuine redundancy payment or an early retirement scheme payment.

Lump Sum E - Amounts you paid for back payment of salary or wages that accrued more than 12 months ago or any return to work payments |

You must include all amounts you withheld from lump sum payments in the total tax withheld. Do not include amounts for ETPs that were not rolled over. You must complete a separate payment summary for ETPs. |

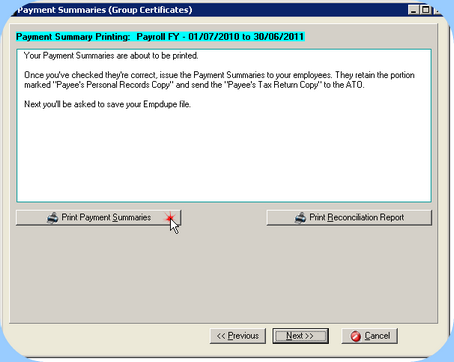

Now you are ready to print your Payment Summaries or the report with which to compile them, depending on your previous selection.  Print Payment Summary If required, a Reconciliation report may also be printed for your own records.

If you are using Dealerlogic to provide information with which to complete the ATO pre-printed Payment Summaries, you are now finished! If you’ve printed Payment Summaries on plain paper, press Next. |

The next step is to create the summary Empdupe file. This is a text file that includes the information on all employees setup to be included in Payment Summaries. It adds your dealership details as entered at Step 2, and totals the records. It is sent to the Tax Office via the ATO Business Portal.. •The Empdupe file must be labeled if it contains Testing data, normally you will leave the “Production Data” ticked •Click Save Empdupe file, and use the “Save As” window to specify a file name and path you will recall later. Note the Empdupe file has a default file extension of “.A01”. You should leave the file extension ‘as is’, but the file name may be suffixed with an identifier of your own, e.g. EmpdupeDS.A01 etc. •Once the Empdupe file is saved, it may then be uploaded to the Tax Office via the ATO Business Portal or the ECI software for direct transmission. |