Selling Consignment Vehicles

When completing the Sale & Settle tabs of the consignment stock card, there are few visual differences to recording a non-consignment vehicle. In most respects you can record the sale in the same way as usual, with the main differences occurring in the internal recording of the accounting transaction, and in the calculation of the Profit tab.

It is important to remember that when you sell a consignment vehicle, it is on someone else’s behalf. It is not your vehicle, and the Sale price does not represent income to you. Your income is derived from:

1.commission on the sale price as negotiated with the vendor, and

2.any add-on extras you have negotiated with the customer.

Therefore when the Sale transaction for vehicle is created in accounting, it is not directed to a Sales Income account, but to a “Clearing” account, as it is not your money but held in trust for someone else.

When any Consignment stock card is sold Dealerlogic creates two Sale Journals attached to the stock card. This means you can correctly differentiate between the sale of the vehicle on behalf of the vendor and the sale of any add-on extras, and this is regardless of whether any add-on extras are sold or not – if none have been, then the second sale journal will be recorded for $0.

At the time of writing, no Australian state’s legislation permit the accepting of a trade-in as part payment towards a consignment vehicle, so this field has been specifically excluded from the Settle tab.

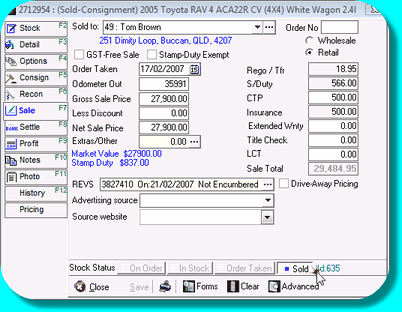

Record the sale of a consignment vehicle

•Begin recording the Consignment sale by marking the status of the stock card to “Order Taken” or “Sold” as appropriate; •Record the customer (purchaser); •Record the Order Taken date and Odometer reading on sale; •Record the Sale Price and any extras sold to the purchaser •Save the stock card. •If the status is “Sold” Accounting Sale journals are created. •Note: The Sale transactions cannot be accessed from this button, unlike non-consignment stock cards. To view these transactions, open from the Sales Register or the Sale Journal. |