To create a sale on a stock item, complete the Sale details on the stock card, and change the status to Order Taken or Sold. See more on stock statuses here.

Once the required status has been selected via the buttons, required entry fields will be highlighted in pink. An Order Taken status requires less mandatory information than a Sold status

The Sale tab of the stock card records the items that have been sold to the customer, whilst the Settlement tab records the way the customer is going to pay for those items.

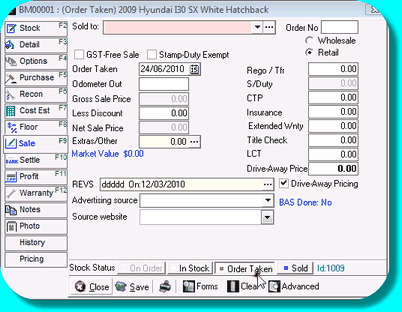

Stock card showing Order Taken status

1.Locate the stock card in the stock browse and open by double-clicking or pressing Edit. 2.Select Order Taken status (or Sold) 3.Select a purchaser client card 4.Specify any attributes belonging to this sale such as GST-Free etc 5.If the Purchasers client card is designed a Motor Dealer, the Sale will be marked as Wholesale. 6.Enter all components of the Sale Price into their associated fields 7.If DriveAway pricing is used, enter the total price, and any individual components such as Title Check or any other extras, and the sale price will be calculated for you. 8.Obtain a current REVS or VCheck certificate (only do this on the day of delivery). 9.If desired, select the Advertising Source, and the Source Website. 10.Save |

If the customer has provided to you evidence that confirms they are entitled to a GST-Free status, the sale price must be reduced by the amount of GST that would otherwise be paid, and use the GST-Free tick to ensure that no GST is calculated or included in the Sale journal or your next BAS. Ticking GST-Free will not "automatically" reduce the sale price by the GST, you'll need to do that - divide the original sale price by 1.1 to arrive at the GST Free amount. If you sell a stock item with a Notional ITC Type as GST Free there is no Input Tax Credit available on the purchase of the vehicle. That's because a Notional ITC is limited to the lesser of 1/11th of the purchase price OR the GST payable on the sale. If there is no GST payable on sale, there is no ITC available. That means that when you make a Notional stock item GST Free you will significantly affect the resulting profit. This is a known issue for motor dealers, and although the ATO takes the position that you are not to be disadvantaged and are entitled to charge the customer a price that will achieve the same profit as you would have if the stock item was not sold GST-Free, in practice this is only possible if you are aware of the customer's GST-Free status before the sale is negotiated. |

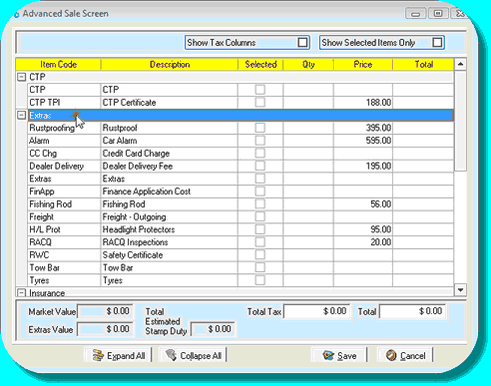

The Extras/Other field is also known as the Advanced Sale Screen and can be opened either by editing the Extras/Other field, or by using the Advanced button at the bottom of the stock card. This area is where you can select additional items as part of the sale that have been created as Item Codes. Each item is listed within its Category and the Categories represent the individual fields shown on the Sale tab. The GST behavior will always come from the Sale field the item belongs to. Select each required Sale Item then adjust the Sale price if necessary. When complete, press Save and the selected Extras will be populated into their respective categories on the Sale tab.

Advanced Sale Screen showing Extras category

|

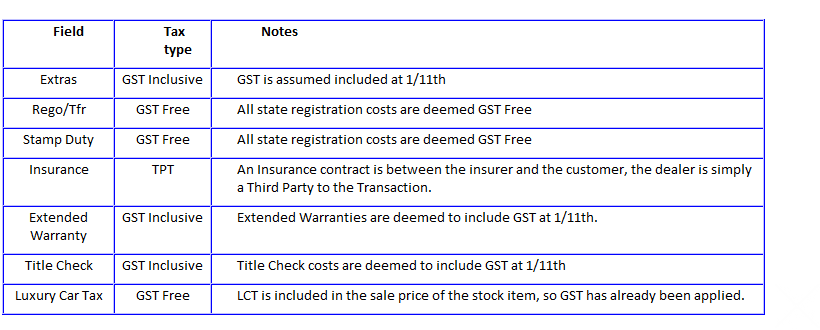

![]() GST associated with fields on the Sale tab

GST associated with fields on the Sale tab

Each field on the Sale tab has pre-determined GST behaviour as follows that cannot be overruled, except in the event of a sale marked GST Free, where no GST will be calculated. |

|